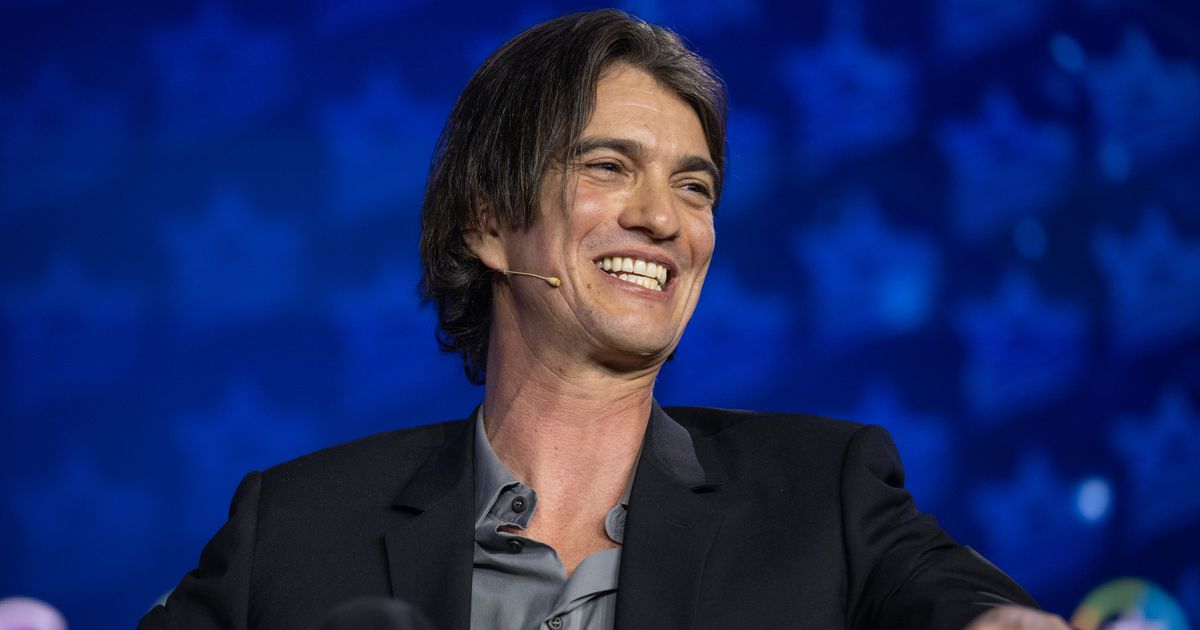

Photo: Shahar Azran/Getty Images

When Adam Neumann Launched Flow, His Residential Real-Estate Venture, A Little Over Three Years Ago, A Lot of People Were Skeptical. The man who had Run Wework into the ground In Spectacular Fashion Was Launching another vague, vibe-y real-estate start-up? And People were once Again Throwing Money at Him to do it? Like Wework, Flow Seemed Overvaluded-It Had A $ 1 Billion Valusion Right off the bat, thanks in part to $ 350 million from Andreessen Horowitz’s A16z Venture-Capital Firm, The Larest Single Investment at that Made. “If a start-up is warr $ 1b before it launches a Product is probably scam,” Jason Calacanis, A Podcaster and Angel Investor, tweeted at the time.

Sink then, The Details Surrounding Flow Have Remained Mysterious. But Money Keeps Coming in. Bloomberg recently reported that neumann has raisied an additional $ 100 million, Including More Money From A16z, which More Than Double Its Valuation to $ 2.5 Billion, and is Planning an IPO. To anyone in the multifamily busines, it is more than a little baffling: Flow Has a portfolio of About 4,000 luxury rentals in several southeastern cities – sizable for a regional company but hardly Huge. (Preferred Apartment Communities, Which Was Acquired by Blackstone In 2022, has 12,000 in the region.) And in terms of new development, it has just one currently under Construction: A 466-Unit Rental/Condo Tower in Miami. It also JUST SOLD Its financially troubled nashville Development at a loss. Besides Trendy Interiors, Intangible Tag Words Like community and well–beingand a Tote Bag that reads “Holy Shit I’m Alive,” IT’S UNCLEAR What Flow is Offering that Other Luxury Landlords Aren’t. So why do People keep throWing Money at it?

AFTER the Pandemic and His Disgraced But Lucrative Exit From Wework, Neumann bought Majority stakes in a portfolio of 4,000 rental units in Atlanta, Fort Lauderdale, Miami, and Nashville to be Owned and Operated by Flow. Break Wall Street Journal Reported that Neumann, Who Left Wework A Multibillionaire AFTER BEING forked out As CEO, was Investing His Own Money This Time Around. It SEEMED AS IF NEUMANN HAD Learned One Thing From His Previous Run: Unlike Wework, WHICH WAS BUILT AROUND AND MANAGING OFFICE IT DIDN’T, FLOW WOULD THE PROPERTIES IT MANAGED, A MORE STORK BUSINESS MODEL. Otherwise, IT Shared Many Similariities. Flow Propperties, Like Wework, Waled Also Have Lots of Perks, Services, and Cool Branding Bundled in, THAT WOULD, Theoretically, Help Out and Appear Innovative in a Crowded Industry.

Neumann is Also Building Several Projects that are in Various Stages of Completion: Flow HouseA 466-Unit Condo in Miami WorldCenter That’s Expected to Open Later This Year (there’s Also A Flow Miami Rental Nearby). Neumann is also partnership with Israeli firm Canada Global on a Three-Tower Mixed-Use Office and Residential Complex in Adventures and to Redevelop A 16-ACRE Trailer Park in El Portal Into a Mixed-Use Project with 2,380 apartments. The Company Also Has Some Properties in Saudi Arabia, Accounting to Its Website.

Neumann Launched Flow in the Summer of 2022, he CLAPAND The Company Wolding the Housing Industry by Creating Community, Fostering Well-Being, and, In the Words of Horowitz, Transforming Renting An Apart from “A Souleless Experience” Into, Well, Something Less Souleless.

Accounting to Its Website, Flow Creates “Communities Designed to Connect You With Your Neighbors, Yourself, and the Natural World.” By providing an “Elevated Experience” and a “community” to tenants, Neumann explained at a conference, they would be like “part of something.”

In reality, this seams to shake out to something along the lines of wework but for housing: apartments with more flexible lease (short-term rentals), an option to rent a supplished, appealing, and a more robust slate of community. While there are were early suggestions of using Crypto Wallets for Payments, Rent-to-AWN Models, and Tech Enhancements (for Instance, There’s a Flow one Executive Reference to As the “lubricant” of its olas building in Fort Lauderdale, Although Online Systems Standard in luxury rentals), so far the innovation has been limited. It essentially seams focused on improving management and tenant experience. Wann Business Insider Visited Society Las Olas, Residents Reported That The Building Was Cleaner than it has ben under the previous management, with five staff in the lobby (or “Residents Lounge” as Flow Rebranded It) Versus A Single Concierge, New Gym Equipment, and a Lesy Clunky App. There’s Also a New Poolside Restaurant.

From a business perspective, this all seams to be in service of reducing tournover – Expensive for Both landlords and tens. Do Residents Feel A Greater Sense of Connection in a Well-Run Building? Probably, at least in the sense of not counting down the days unil their lease is up. But neumann has suggestted it fosters a more fundamental sense of ownership. Nor he said at A Conference In 2023: “If you’re in an apartment building and you’re a renal and your toilet gets clogged, you call the super. If you’re in your own apartment and you bough it and you are toilet gets clogged, you take the plunger.” (Presumably, The Lines blur in a flow Building; A Flow Rentter Wauld Take Up Their Own Plunger, and A Flow Owner Wauld the Super Because they would be alone in the process.)

Despite What Happened at Wework, A Number of People I Spoke with Pointed Out that Neumann is Really Good at Convincing to Buy Into His vision and Give Him Money. “He knew how to create a fun atmosphere and underestands the vibe between art and real estate,” Says a multifamily Developer. He is, in Other Words, Really Good at Branding. And Maybe the Stodgy Image of A Luxury-Apartment Landlord Could USE SOME REBRANDING?

A BUSINESS BASED ON MULTIFAMILY HOUSING IS ALSO A LOT VOATLE THAN ONE BUILT ON SUBLAZING OFFICE SPACE à la wework, as the office marks crash and wework subsequents bankruptcy Illustrated. When the Value of Office Space Plummeted, Wework was Locked ino Expensive Leases It Had to Eeth Renegotiate or Lose Money. Multifamily Housing, on the Other Hand, is far more stable. If Rents Stagnate, The Country Has a Major Housing Shortage, and Demand is Going to Remain High.

While no one i spoke with expert flow to anything revolutionary, the designs pointed out that neumann might very well a coma-raise tons of capital by promising and cutting-edge tech. And by the time it is clear that the revolutionary stuff isn’t going to pan out, it has become a huge, albeit far -so traditional, player in the industry.

“If you’re an investment company, part of what Makes you sucesssful is the ability to raise Money,” Says the Developer. “I think he has decent chance of success.

Neumann Continue to make deals with new partners and investors, Most recently the deals in adventure and el portal with Canada Global. But he’s Also Lost One Property and a Majority Stake in Another: Flow JUST SOLD ITS Financially Troubled 358-Nashville Property to Tijman Spair for Less than it paid. (The Property Lost $ 3.7 Million in 2022 and $ 3.6 Million in 2023 Due to Rental Concessions and Capital Costs; Flow Told Business Insider It has never managed the Proppery and was a minority owner.) Flow is also reportedly selling a stake In the Company’s Buckhead, Atlanta, Property, Rumored to be distresses, to another multifamily landlord. To be fair, a lot of rental protirest in the southeast have experiences Similar problems. A Finance Researcher i spoke with explained that the sunbelt rental markets saw huge invites after Covid, Were subsequently flooded with new units coming online, and areing rents fall.

As for the Near Future, Bloomberg Reported that, Accounting to Its Executives, Flow Would Be Cash Flow Positive Sometime This Year. In Other Words, Its Still Ling Money.

اترك تعليقاً