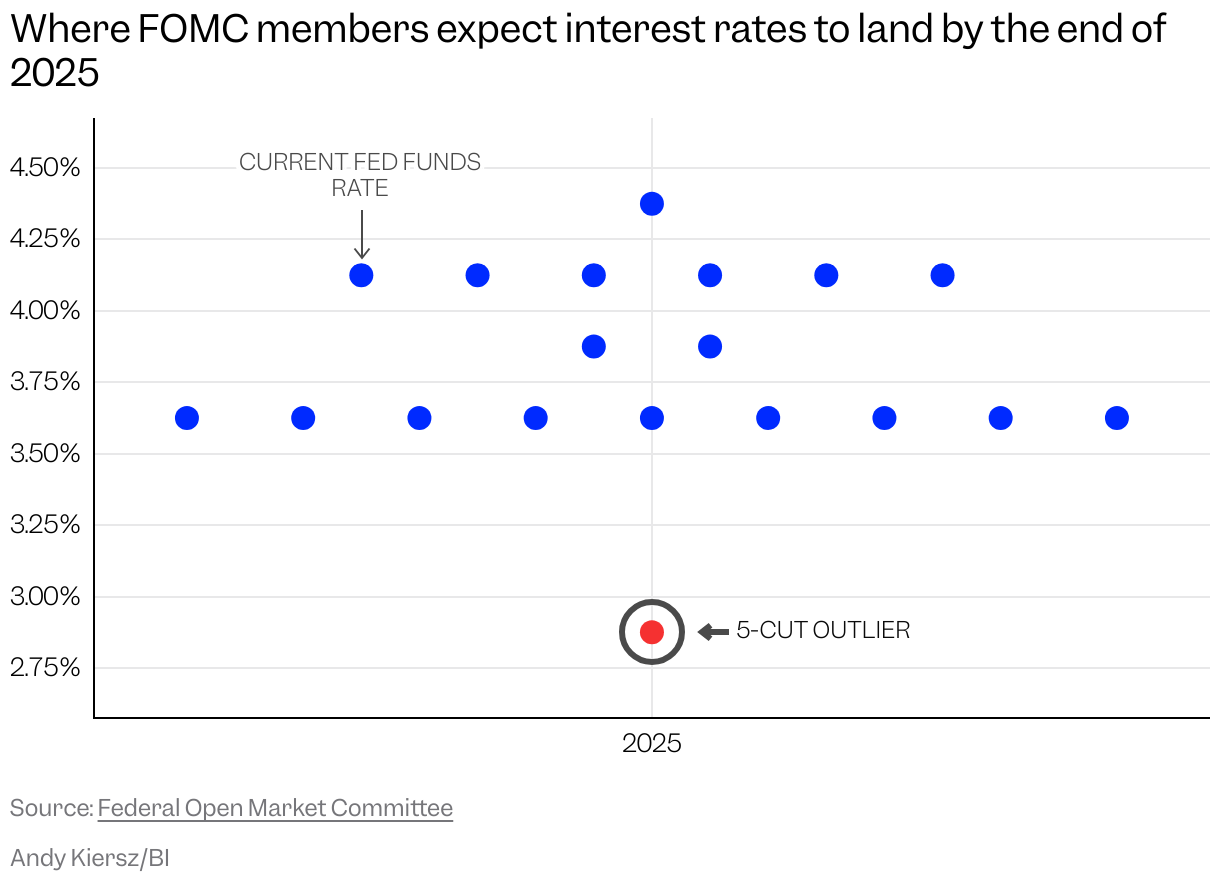

One of these dots is not like the other.

The Federal Open Market Committee Announed A Rate Cut Wednesday, its First Policy Change of the Year. The Quarter-Point Reduction is in Alignment with Expectations and A Reaction to Slow Growth in the Job Market and Stubborn Inflation.

Alongside The Rate Cut, The Fed Releas the Fomc Members’ Economic Projections For the Next Few Years, Including Where they Project Interest Rates to End up. The Median Member Expective Another Half Percentage Point of Reductions by the End of the Year-or One Normal-Sized Quarter-Percent Cut at Each of the Two Remaining Fed Meetings.

But one member Called for something more environmental, outlining a full 1.25 Percentage points of cuts, or the equivalent of five typical cuts.

If the Fed Were to Move Forward With That Member’s Suggested Cuts, It Wauld Require Multiple Exceptionally Far Moves Through the rest of the year, which are typically reserved for Major Economic Downturns.

In addition to the strom downward outlier, one fomc member projected that rates be back above 4.25% by the end of 2025. That Waled Walking Back Wednesday’s Rate and Actually Hiking Rates by A Quarter Percert From.

The Central Bank Said It Continue to Make Rate Decisions Based on Key Markers of Economic Health, Like the UNEMPLOYEENT RATE, NONFARM PAYROLL JOB Growth, Inflation, and GDP. The Committee Members have a dual mandate to maintain stable prices and promote maxpoyment, a goal that has especily difficult in recent months.

At wednesday’s press conference, Powell Said and Waould Expect Some Difference Opinions Among Fed Members They May Have Difference Priorities for the Dual Mandate.

“It ‘Natural,” Powell Said. “Think it would actually be surprisally if you didn’t have a wide range of views in this highly unusual situation, and we do.”

How the ‘dot full’ reflects the Fed’s Economic Outlook

The “dot full” outlines economic project by each member of the Fed. Taken Together, the full of gives a marker where monetary policy beded in the short and long term.

Specific commutee members are not named alongside their projections.

Powell Said the Latest Job Growth Revisions Gave the Fed “A Very Different Picture of the Risks of the Labor Market” and Could Warrant Future Policy Changes.

The fed chair has Also been under pressure from the Trump Administration and Fellow Fed Leaders to Cut Rates in September – and Continue Lowering Rates. Fed Governors Michelle Bowman and Christopher Waller Dissenter July’s Hold Call, and New Member Stephen Miran Dissenter to Wednesday’s Call, Preference a Half-Paint Cut.

Powell Said there was no United Support for a bigger cut in september.

“There wasn’t widespread support at all for a 50-basis point cutt. We’ve so far apothes hikes and very far away rate cuts in the last five years.

He added that he is open to discussing Bigger Cuts with the commutee in the futures, and he doesn’t regret his previous restrictive policy strategy. Any decisions from the commmittee will be solely bassed on in-the-moment economic data, he said.

“That’s Really All That Matters and That’s How to Work,” He Said. “That’s in the dna of the institution that not going to change.”

Source link

اترك تعليقاً