The latest step in $ 34 Billion Brevan Howard’s Evolution is a Big-Name Hire Sliding Into a New Role.

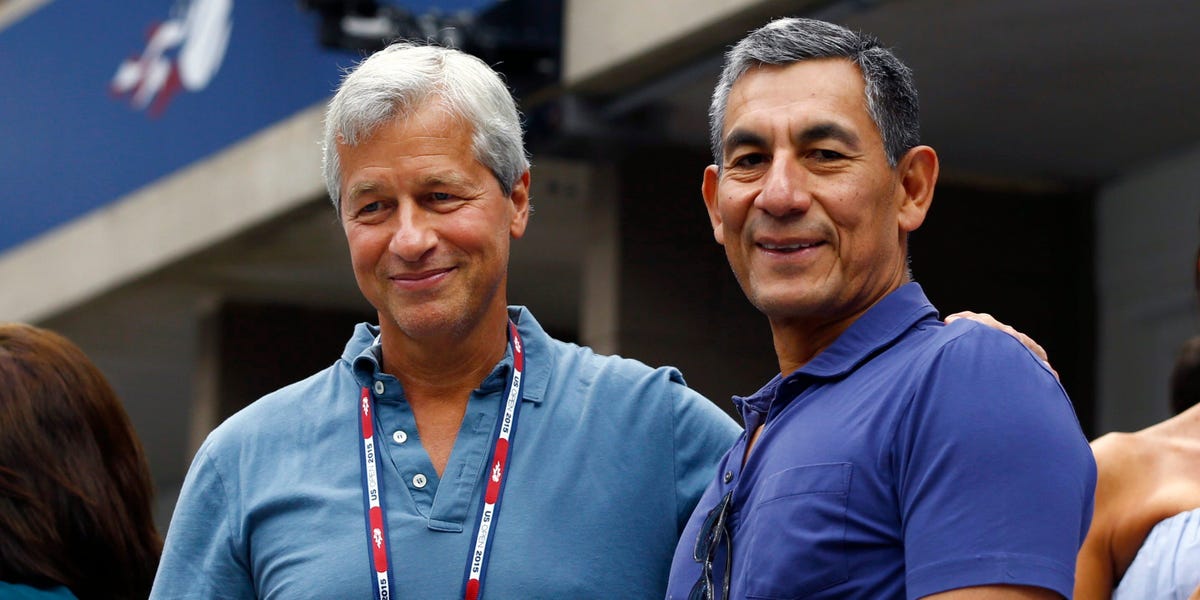

Form Jpmorgan Investment Banking Leader Carlos Hernandez is Jaining Brevan Howard Group as its First-Go Executive Chair. Hernandez Spent Close to Four Decades at JPMORGAN, eventually rising to be the executive chair of the investment and serving as a member of CEO Jamie Dimon’s Operating Committee.

A person close to the manager told business insider that the internal roles is sistly focused on high-level strategy and client development. He joined the firm Earlier this month.

In a staff to Business Insider, Brevan Howard Ceo Aron Landy Wrote that Hernandez is a “Longime Friend of Our Firm” With “Unparalleled Relationships With Global Institutions.”

“We look forward to benefiting from His Expertise and Guidance as we continue to desvelop and strengthen our investment platform,” Landy Said.

Dimon, Hernandez’s Former Boss, Told Bi in a Statement that “is an exceptional leader and human being, and Will Bring Tremendous Experience and Value to his New Role.”

Breva has expanded Significantly from it macro roots, becoming a more diversified investment platform that has a stand-alone crypto unit and offices in locations as abu dhabi. The firm now has more than 145 Portfolio Managers, Compared to 35 in 2019.

As Such, Brevan is No Longer Dependent on the Trading Brilliance of Its Billionaire Founder, Alan Howard. Howard No Longer Manages Money for the firm but is styil the Majority Owner. IN 2020, He tourned the CEO Role Over to Landy, the One-Time Chief Risk Office.

Howard’s Current Role, WHICH IS ALSO FOCUSED ON CLIENT RELATIONSHIPS AND LONG-TERM STRATEGY, WILL NOT CHANGE, THE PERSON CLOSE TO THE FIRM SAID.

Hernandez retired from JPMORGAN IN 2023 AFT 37 years at the firm.

In a staff, Hernandez Said he look for Working with Landy and the Firm’s Leadership Team on “Strategy and Key Relationship to Help Accelerate Its Success and Expand Its Impact on the Global Investment Landscape.”

The Manager’s Longest-Running Strategy, The Master Fund, Had a Strong April, returning 4.5% in the turbulent month. This Gain Trimmed The End’s 2025 Losses to 1.5% Through the Year’s First Four Months.

اترك تعليقاً